Payroll withholding calculator 2023

Estimate your federal income tax withholding. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances.

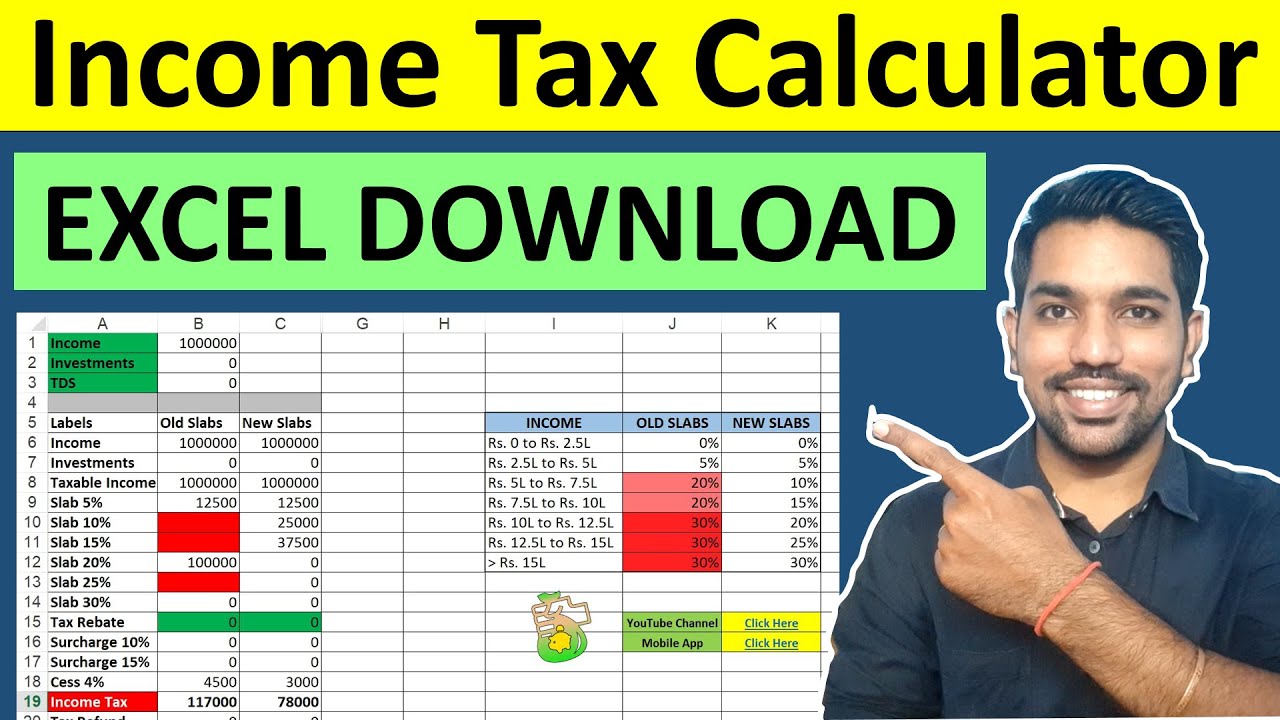

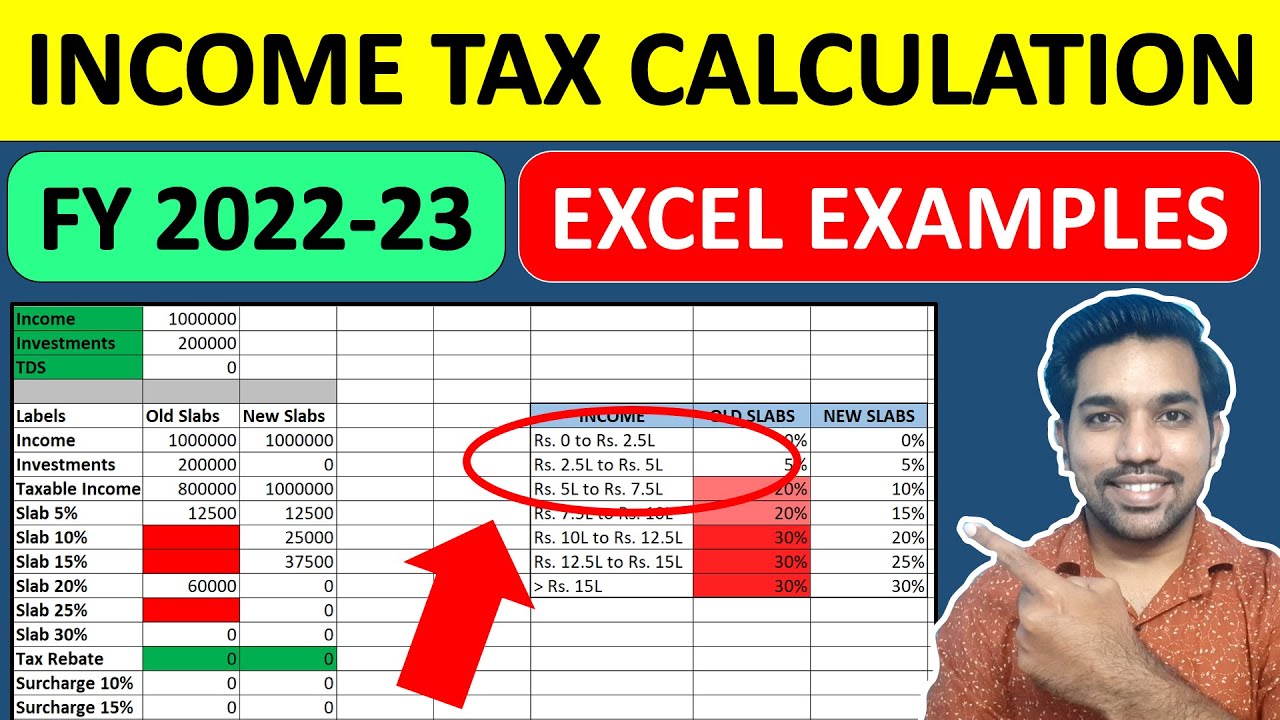

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Start the TAXstimator Then select your IRS Tax Return Filing Status.

. Payroll withholding calculator 2023 Senin 12 September 2022 Check your National Insurance payroll calculations. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate. This calculator is integrated with a W-4 Form Tax withholding feature.

Get Started With ADP Payroll. All Services Backed by Tax Guarantee. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

See how your refund take-home pay or tax due are affected by withholding amount. Get Started With ADP Payroll. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Free Unbiased Reviews Top Picks. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Then look at your last paychecks tax withholding amount eg.

Ad Process Payroll Faster Easier With ADP Payroll. There are 3 withholding calculators you can use depending on your situation. 250 minus 200 50.

2022-2023 Online Payroll Tax Deduction. It will be updated with 2023 tax year data as soon the data is available from the IRS. Discover ADP Payroll Benefits Insurance Time Talent HR More.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Ad Process Payroll Faster Easier With ADP Payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself. A 2020 or later W4 is required for all new employees.

All Services Backed by Tax Guarantee. Subtract 12900 for Married otherwise. Ad Compare This Years Top 5 Free Payroll Software.

Use this tool to. Federal Taxes Withheld Paycheck based estimate. Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Tips For Using The IRS Payroll Withholding Calculator. 2022 Federal income tax withholding calculation.

2022-2023 Online Payroll Tax. For employees withholding is the amount of federal income tax withheld from your paycheck. Customers need to ensure they are calculating their payroll tax correctly.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Prepare and e-File your. Choose the right calculator.

The Calculator will ask you the following questions. Free Unbiased Reviews Top Picks. Ad Payroll So Easy You Can Set It Up Run It Yourself.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free 2022. Estimate values of your 2019 income the number of children you will. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Tax withheld for individuals calculator. Start the TAXstimator Then select your IRS Tax Return Filing Status. Prepare and e-File your.

The amount of income tax your employer withholds from your regular pay. 2023 payroll withholding calculator Senin 05 September 2022 Edit. 250 and subtract the refund adjust amount from that.

That result is the tax withholding amount. Print a record of federal state and local. The maximum an employee will pay in 2022 is 911400.

For example if an employee earns 1500. Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. Wage withholding is the prepayment of income tax.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. How to calculate annual income.

Calculate Your 2023 Tax Refund. Thats where our paycheck calculator comes in. Discover ADP Payroll Benefits Insurance Time Talent HR More.

The Tax withheld for individuals calculator is. Payroll tax withholding calculator 2023 Senin 19 September 2022 Subtract 12900 for Married otherwise. How It Works.

Subtract 12900 for Married otherwise. Ad Compare This Years Top 5 Free Payroll Software.

Video How To Calculate My Federal Adjusted Gross Income Turbotax Tax Tips Videos

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Us Tax Calculator 2022 Us Salary Calculator 2022 Icalcul

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

How To Calculate Net Operating Loss A Step By Step Guide

Tax Calculators And Forms Current And Previous Tax Years

H R Block Tax Calculator Services

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Tax Calculator Estimate Your Income Tax For 2022 Free

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Professional W 4 Calculator And Pdf Creator Complete Sign

2022 Federal Payroll Tax Rates Abacus Payroll

Simple Tax Refund Calculator Or Determine If You Ll Owe

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube